Asia is becoming a key player in the global economy. It offers many chances for foreign investors to make money. The Asian Development Bank (2023) says there was a big jump in foreign direct investment (FDI) last year.

This shows Asia is a great place for businesses to grow. It’s a chance for international investors to dive into a vibrant market.

Why Invest in Asia?

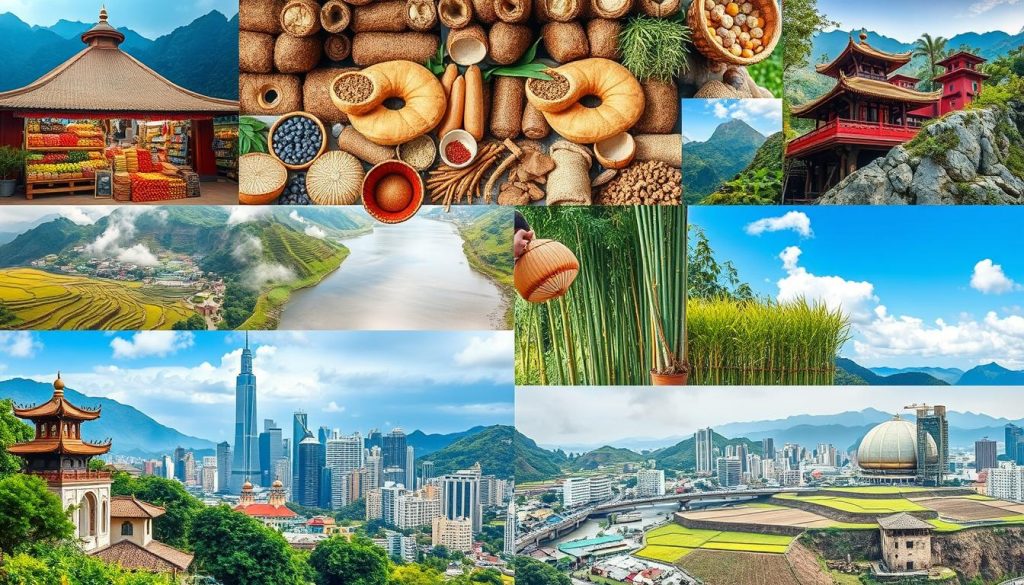

Investing in Asia is attractive due to its strong economic growth and large consumer market. Countries like India and Vietnam are growing fast, making them key players globally. Their growing middle class and urban populations create steady demand in many sectors.

Asia’s strategic location boosts trade, linking Europe, Africa, and the Americas. This makes it easier for investors to move goods and expand their markets. It’s a big plus for those looking to grow their business.

Asia’s markets are diverse, offering different opportunities in each country. Whether it’s tech, manufacturing, agriculture, or retail, there’s a place for every business. The region’s entrepreneurial spirit makes it a great place for innovation and investment.

The Economic Landscape of Asia

The Asian economic landscape is dynamic and strong. It’s shaped by fast growth and big contributions to global trade. The latest IMF reports show Asia makes up over 40% of global GDP. This highlights its key role in the world economy.

Countries like China and India are leading the way with impressive growth. Meanwhile, ASEAN nations are becoming more important. They all play a big part in Asia’s economic success.

Recent data shows the region has bounced back well from global crises. Changes in economies make Asia a great place for foreign investment. Trade agreements and regional teamwork also boost financial prospects, offering many investment chances.

This good economic situation helps each country and encourages teamwork across borders. Investors can use these trends to understand and work with the Asian markets. They can plan their strategies to match the promising growth paths in Asia.

Key Markets for Foreign Investment

Foreign investors looking at Asia will find several key markets. Countries like Singapore, India, and Indonesia stand out. Each has its own strengths in infrastructure, laws, and market size.

Singapore is a top choice for foreign investors. It has a great location, modern infrastructure, and friendly business rules. The World Bank says Singapore is easy to do business in, making it perfect for new projects.

India is also a hot spot for investors. It has a growing middle class and fast tech progress. The government has made it easier for foreign investors to come in.

Indonesia is another big chance for investors. It’s the biggest economy in Southeast Asia. The government is working to improve its infrastructure and attract more foreign investment.

Investors should look into different areas in these countries. The chance for good returns is high. Asia’s key markets are attracting global investors, making it a key place for investment.

Profitable Business Opportunities in Asia for Foreigners

Asia’s economy is growing fast, opening up many business chances. Foreign investors can find success in various sectors. It’s important to pick the right sectors to invest in Asia for lasting success.

Key areas include technology, healthcare, and renewable energy. These sectors are growing fast. The fintech and e-commerce industries are also becoming more important, as shown by a World Economic Forum study.

Promising Sectors for Investment

When looking at business opportunities in Asia, consider these sectors:

- Technology: This includes software, artificial intelligence, and cybersecurity. There’s a big need for new solutions.

- Healthcare: Investing in pharmaceuticals, medical devices, and telemedicine meets growing healthcare needs.

- Renewable Energy: Governments are focusing on green practices. This creates chances in solar, wind, and hydropower.

- Fintech: With more digital payments, this sector has huge growth and innovation potential.

- E-commerce: The move to online shopping opens up many business opportunities.

Market Entry Strategies

Choosing the right way to enter Asian markets is key to success. Many foreign investors use these strategies:

- Joint Ventures: Working with local firms can help with rules and give market insights.

- Franchising: This method quickly builds a brand presence and uses local knowledge.

- Local Partnerships: Working with local businesses boosts credibility and grows networks.

- Direct Investment: Starting a fully-owned subsidiary gives full control over operations.

Understanding Regional Differences

The Asian continent is a mix of economic and cultural differences. These differences shape investment opportunities. Each area has its own special traits, showing the wide range of business environments in Asia.

South Asia Insights

South Asia has a lot to offer, especially in farming and textiles. It’s a key place for investors looking for cheap labour and resources. With a growing population and more demand for food, it’s a great time to invest in South East and East Asia.

Southeast Asia Trends

Southeast Asia is known for its growing tourism and digital changes. It’s a mix of old traditions and new ideas. Investors are drawn here by a growing middle class and better connections, showing the need to understand Asian markets.

East Asia Opportunities

East Asia, especially China and Japan, leads in tech and innovation. There are many chances, especially in fintech and making things. These places have strong infrastructure and skilled workers, making them good for investment.

Investment Challenges and Risks

Foreign investors face many risks in Asia that can stop them from entering and succeeding in the market. Political instability is a big worry, as changes in government policies or unrest can make things uncertain. Also, regulatory hurdles are a problem, with complex laws and regulations that vary by country.

The Global Risk Report shows that many investors worry about market entry barriers. This shows how important it is to understand these challenges. Cultural differences can also make negotiations and business practices hard, so investors need to get used to local customs and norms.

To deal with these challenges and reduce risks, doing thorough research and risk assessments is key. A structured approach helps investors spot risks early and plan how to tackle them. Working with local partners who know the market well can also help investors overcome hurdles.

Legal Considerations for Foreign Investors

Entering Asian markets needs a deep understanding of legal rules for foreign investors. These rules protect local businesses while welcoming foreign money. Each Asian country has its own legal system. This affects how companies are run, intellectual property is handled, and contracts are enforced.

It’s vital to work with local legal experts to follow Asian market rules. They know the details of each country’s laws. This knowledge is key because some countries are more open to foreign investment than others.

- Knowing the laws on foreign ownership and partnerships is key.

- Being aware of tax rules and benefits can help your investment plans.

- Protection of intellectual property rights varies a lot. Some countries do a great job, while others don’t.

Investors must do thorough research to avoid legal problems. Understanding the rules can lead to successful investments in Asia.

Government Incentives for Investment

Many Asian governments see the value in foreign investment. They offer various incentives to draw in capital. These include tax benefits for foreign investors, helping businesses grow in competitive markets.

Countries like Malaysia and Thailand have set up special investment incentives. They offer tax holidays, lower corporate tax rates, and sometimes grants. These efforts make these places more attractive to investors.

- Malaysia offers tax incentives for manufacturing and technology.

- Thailand has special economic zones with tax breaks and easier rules.

- Vietnam and Indonesia also aim to improve their investment climates.

Using these incentives can greatly increase an investor’s returns. This makes Asia a great choice for expanding portfolios.

Case Studies of Successful Ventures

Looking at case studies in Asia shows the exciting opportunities for foreign investors. Many businesses have done well in this varied region. They show how foreign investments can be successful. Especially in technology and manufacturing, companies have adapted well to local markets.

Technology and Start-ups

Technology ventures in Asia have seen huge success. Companies like Grab and Go-Jek have changed the transportation sector. They have also become key players in the digital economy.

By using the region’s growth and a tech-savvy population, they show the big potential for foreign investments in this area.

Manufacturing and Export

Companies like Samsung have made a big impact in Asian markets. They have used the region’s low production costs to their advantage. This has given them a competitive edge.

Their stories are examples of how strategic investments can improve operations and reach more markets.

Market Research and Insights

Market research in Asia is key for foreign investors looking for good business chances. It helps them understand consumer habits, industry trends, and economic signs. This knowledge is vital for making smart investment choices and avoiding risks in new markets.

Companies like Statista and Nielsen offer important insights for investors. Their reports are full of useful information. This includes:

- Consumer preferences and habits

- Emerging market trends

- Competitive landscape analyses

- Regulatory changes influencing market dynamics

By using this data, investors can spot chances and plan their strategies. They can better handle the complex Asian markets with good market research. Keeping up with the latest insights is key to staying ahead and growing in the long run.

Networking and Building Relationships

Networking in Asia is key to business success. Knowing how to build relationships can really help. The Asian market values trust and long-term connections. This makes networking crucial for foreign investors.

Here are some effective strategies for building relationships:

- Engaging in local community events to foster connections.

- Utilising platforms like LinkedIn to expand investor networks and maintain regular communication with local business leaders.

- Participating in industry conferences and seminars, which provide valuable opportunities to meet influential figures and potential partners.

In countries like Japan and Indonesia, personal relationships are very important. Spending time on networking can lead to loyalty and trust. It’s essential to understand the local culture and etiquette when meeting potential contacts.

Future Trends in Asian Investments

The investment scene in Asia is changing fast. Sustainable investments are becoming more popular. This shows a worldwide move towards caring for the planet in finance.

People want their money to help the environment. This makes green projects a promising area for investment in Asia’s future.

New tech is also changing the game. Things like artificial intelligence and blockchain are making waves. They’re being used in finance and improving supply chains.

These tech advances are not just changing markets. They’re also creating new areas for growth in Asia. These could bring big profits.

The health and wellness sector is also on the rise. As people care more about their health, investing in this area is becoming attractive. It offers chances for both local and international investors.

Brands focusing on health are doing well. They’re catching the eye of investors looking to make money in this key market.

Regulatory changes are also on the horizon. Governments might make rules to attract more foreign investment. This could make it easier for businesses to operate.

These changes will be important as the world economy goes through ups and downs. They could affect where investors put their money.

Resources for Foreign Investors in Asia

Foreign investors looking to invest in Asia have many resources at their disposal. These resources are designed to help them make informed decisions and enter the market smoothly. The Asian Investment Promotion Network is a great example, offering deep insights into local markets and investment conditions.

Investment promotion agencies also play a key role. They help connect investors with local businesses. Many Asian countries have government offices that support investors, helping them with legal and procedural issues.

- Trade missions offer great networking chances, helping investors build important connections.

- Consultancy services give expert advice on rules and strategies, ensuring success.

- Online platforms provide the latest on economic trends and sector performance, crucial for planning.

Using these resources can greatly improve the chances of successful investments in Asia. Guides for foreign investors help understand the different business environments. This leads to successful ventures.

Success Stories of Foreign Investors in Asia

Foreign investor success stories in Asia are growing, guiding those thinking about entering these markets. Companies like Unilever and Coca-Cola have changed their ways to fit in with local tastes. They show how important it is to adapt to local markets for success.

Samsung is another example, growing its business and helping the community. This shows that success comes from knowing the local scene and building strong partnerships. By doing this, foreign investors can stay in Asia for the long term.

These stories encourage and motivate others to invest in Asia. They show the mix of creativity, local fit, and community ties is key. This mix opens doors for new ventures in Asia’s exciting markets.