Starting a business in Australia is a rewarding venture. It requires a deep understanding of the legal requirements. Entrepreneurs must navigate a complex landscape of business registrations, compliance guidelines, and regulatory frameworks.

These vary by state and territory. This section outlines the fundamental aspects of starting a business in Australia. It focuses on the essential legal considerations that ensure compliance with Australian laws.

Key areas such as taxation, licensing, and health and safety regulations are crucial. They play a pivotal role in shaping an entrepreneur’s journey. By familiarising oneself with these vital elements, prospective business owners can lay a solid foundation for a successful enterprise.

Understanding the Australian Business Environment

The Australian business scene is unique, shaped by many factors. Entrepreneurs must navigate these to succeed. The economy is stable, which is great for businesses to grow.

Australia’s economy is strong, thanks to sectors like tech, education, finance, and tourism. This supports a high Gross Domestic Product (GDP) growth.

Market conditions change with each industry. It’s key to understand these shifts to spot opportunities and challenges. For instance, tech is booming, but other sectors face different challenges.

Knowing these variations helps businesses adapt and stay ahead. It’s all about finding the right strategy for each market.

Culture also shapes the business world in Australia. People here are both relaxed and professional. This affects how businesses interact with employees and customers.

Building strong relationships and clear communication is vital. It’s the key to success in this environment.

In summary, understanding the Australian business environment is crucial. It includes the economy and market conditions. This knowledge is essential for entrepreneurs aiming to thrive in this dynamic market.

Key Definitions for Business Start-ups

Knowing the key terms for starting a business is vital for entrepreneurs in Australia. It helps them make smart choices about their business structure and follow the rules. This knowledge is key to success.

- Sole Proprietorship: This is the simplest form, where one person owns and runs the business. They handle all the work and risks, but also get all the profits.

- Partnership: Partners share the business and its risks. It means more resources but also more shared responsibilities.

- Company: A company is its own legal entity, separate from its owners. It protects the owners from personal risks and offers growth chances.

- Trust: A trust has a trustee managing assets for others. It can offer tax benefits and protect assets.

Using these definitions helps lay a solid foundation for a new business. Knowing these terms well helps entrepreneurs move smoothly through the business world.

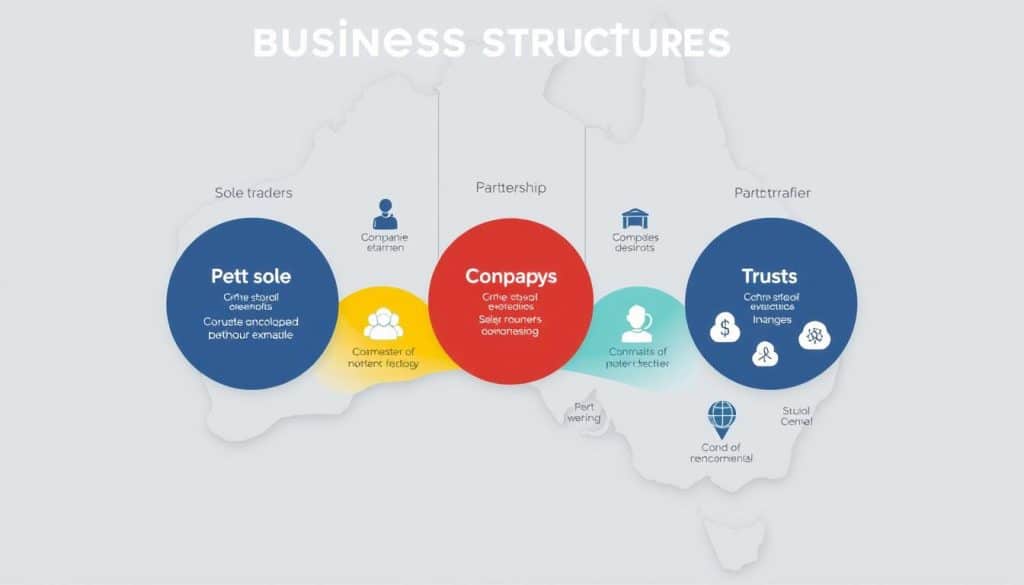

Choosing the Right Business Structure

Choosing the right business structure is key for any entrepreneur in Australia. There are many options, each with its own benefits and drawbacks. These choices affect your legal duties, tax, and personal risk. Knowing about sole proprietorship, partnership, corporation, and trust helps match your business goals with the best structure.

Types of Business Structures

- Sole Proprietorship: This lets one person run a business alone, with full control and ownership.

- Partnership: Partners share ownership and duties. It’s good for combining skills and resources.

- Corporation: A corporation is its own legal body, offering protection for its owners. It’s best for big businesses looking to grow.

- Trust: A trust has a trustee managing assets for others. It offers asset protection and tax benefits.

Pros and Cons of Each Structure

It’s important to weigh the good and bad of each structure:

- Sole Proprietorship:

- Pros: Easy to start and manage, full control.

- Cons: You’re personally responsible for all debts, hard to get funding.

- Partnership:

- Pros: Shared duties, brings in different skills.

- Cons: You’re all responsible together, can lead to disagreements.

- Corporation:

- Pros: Protects your personal assets, makes it easier to get money.

- Cons: It’s more complicated to set up, faces strict rules.

- Trust:

- Pros: Keeps your assets safe, might save on taxes.

- Cons: It’s complex to manage, can be hard to understand.

Legal Requirements for Starting a Business in Australia

Starting a business in Australia means following certain laws. You need to register your business and protect your name. Knowing about the Australian Business Number (ABN) and Australian Company Number (ACN) is key.

Business Registration and Name Protection

Registering your business is vital in Australia. It makes your business legal and helps you get financial services. Protecting your business name is also important to avoid legal issues.

- Register your business name through the Australian Securities and Investments Commission (ASIC) to protect your brand.

- Conduct a name search to ensure your desired business name is unique and aligns with ASIC guidelines.

- Consider trademark registration for broader protection of your business identity.

Understanding ABN and ACN

Every business needs an Australian Business Number (ABN) for taxes and government dealings. Companies also get an Australian Company Number (ACN) from ASIC. These numbers help you follow tax laws and deal with government agencies.

Licences and Permits for Operating in Australia

Starting a business in Australia means you must follow certain rules. These rules vary based on your industry. It’s crucial to know what’s needed to avoid legal trouble and keep your business running smoothly.

Industry-Specific Licences

Some jobs need special licences. These are important in areas like:

- Healthcare services

- Education and training

- Construction and trades

- Transport and logistics

- Hospitality and food services

Getting these licences is key to quality and safety. Make sure you have the right ones before starting your business.

Environmental and Building Permits

Businesses also need to follow environmental rules and get building permits. These are vital for projects that might affect the environment or need construction. You might need:

- Environmental impact assessments

- Land use permits

- Building approvals

Ignoring these rules can lead to fines or delays. So, it’s important to understand and follow these regulations closely.

Understanding Tax Obligations

Starting a business in Australia means dealing with several tax rules. These rules are key for staying on the right side of the law and keeping your finances healthy. Knowing about the Goods and Services Tax (GST) and Pay As You Go (PAYG) system is important. Both are big parts of running a business.

Registering for GST

If your business makes more than a certain amount each year, you must sign up for GST. This tax makes you charge GST on what you sell. You can also get back some of the GST you paid for things you bought for your business.

Keeping good records and filing your GST returns on time is very important. It helps you meet your tax duties.

Pay As You Go (PAYG) Registration

The PAYG system makes you take out tax from money you pay to workers and some contractors. Signing up for PAYG is vital. It ensures you’re sending the right amount of tax to the Australian Taxation Office (ATO).

Following PAYG rules helps with fair taxation. It also keeps you out of trouble with fines for not following the rules.

Employee Rights and Responsibilities

It’s key for businesses in Australia to know about employee rights. The Fair Work Regulations set the rules for employment law. This includes contracts, wages, and working conditions. Employers must follow these rules to create a safe and fair workplace.

Understanding Fair Work Regulations

The Fair Work Regulations shape the relationship between employers and employees. They make sure employees get the minimum wage. Employers must give written contracts that outline pay and work hours.

Following these rules protects employee rights and avoids legal trouble.

Workplace Health and Safety Laws

Workplace health and safety laws are vital for keeping employees safe. Employers need to make sure the workplace is safe. They must deal with hazards and train employees on safety.

Ignoring these laws can cause injuries and legal problems. So, it’s important for businesses to understand and follow these laws.

Intellectual Property Protection

Intellectual property is key for innovation and staying ahead in business. In Australia, it’s important for entrepreneurs to know about trademarks, copyrights, and patents. Each type of IP protects creative works and brand identity in its own way.

- Trademarks: These help make goods and services stand out. Registering a trademark stops others from using it without permission.

- Copyrights: Copyrights protect original creative works like books, music, and art. They ensure creators have the right to their work.

- Patents: Patents give inventors the right to their inventions. They stop others from making or selling the invention without permission. This encourages inventors to keep creating.

Companies that don’t protect their IP risk losing their innovations. The steps to register IP are different, but they’re crucial for protecting creative work. Protecting IP not only keeps a business’s identity safe but also builds trust with customers and partners.

Complying with Advertising Standards

Businesses in Australia must follow strict advertising standards. This ensures their marketing is both ethical and legal. It’s vital to understand these rules to keep customers’ trust and loyalty.

The focus on truth in advertising means all claims must be accurate. They should not mislead anyone.

Truth in Advertising Regulations

The Australian Competition and Consumer Commission (ACCC) watches over these rules. They make sure consumers get honest and clear info. Businesses must not make false claims about what they offer.

Key points of truth in advertising are:

- Products and services must be accurately shown.

- Terms and conditions should be clear.

- Endorsements and testimonials must be transparent.

Privacy and Data Protection Laws

Businesses also need to follow privacy laws to protect customer data. The Australian Privacy Principles (APPs) guide how to handle personal data. Following these laws is crucial for building customer trust.

Important parts of privacy laws are:

- Only collect information that’s needed.

- Data must be stored and handled securely.

- Customers should have access to their data.

Understanding Consumer Protection Laws

Entrepreneurs in Australia need to know about consumer protection laws. These laws protect consumer rights and ensure fair trading. The Australian Competition and Consumer Commission (ACCC) enforces these rules, including those against misleading ads.

These laws give consumers important rights when buying goods and services. It’s vital for businesses to follow these laws to build trust with customers.

Here are some key consumer rights:

- Consumers have the right to accurate information about products and services.

- Goods and services must be of good quality and without defects.

- Consumers can get a refund or a replacement for faulty or wrongly described items.

Knowing these rights helps businesses avoid legal issues and improves their reputation. As laws change, it’s crucial for companies to keep up with their ACCC obligations. Ignoring these laws can result in big fines and harm to their reputation.

Establishing a Business Bank Account

Getting a separate business bank account is crucial for any entrepreneur. It keeps personal money separate from business money. This makes financial records clearer and easier to manage.

It also helps with tax time and makes sure you follow the law.

Business owners in Australia have many banking options. Each bank has its own services and features. When choosing, think about these key points:

- Account fees: Check the monthly fees and transaction costs. They can differ a lot between banks.

- Services offered: Look for services that help your business grow. This includes online banking, merchant services, and financial advice.

- Support: Good customer service is important. It helps a lot when you need help or advice.

Choosing the right business bank account wisely helps with financial management. It boosts your business’s success.

Seeking Professional Advice

Starting a business in Australia? Getting professional advice is key. Business consultants can help you plan and grow your business. They know how to deal with complex rules.

Legal experts are also vital. They make sure your business follows the law. They help with contracts and protect you from legal issues. This gives you peace of mind.

Don’t forget about accountants. They manage your money and taxes. Their advice helps keep your business profitable and legal. A team of experts can make your business run smoothly and reduce risks.