Africa is full of chances for foreign investors looking to make money. It has lots of natural resources and a growing number of people who can buy things. This makes it a great place for business.

The young people and better infrastructure in Africa make it even more appealing. There’s a big interest in technology and farming, which could change the economy. Also, more money is coming into Africa from foreign investors, showing it’s becoming more important worldwide.

Understanding the African Market Landscape

The African market is full of both chances and hurdles. GDP growth rates show how different the economy is. Countries like Nigeria and Ethiopia are growing fast, showing they’re good for foreign money.

A young and growing population adds to the demand for goods. As more people move to cities, the market gets better. This change helps investments grow.

But, the market varies a lot by region. This is because of local rules and culture. Investors need to understand these differences well.

- The tech sector is driving growth in Africa, with lots of new ideas and digital changes.

- Agribusiness is key for many economies, with big chances for growing food and supply chains.

- Renewable energy is becoming more popular, helping meet global and local energy needs.

Organisations like the African Development Bank highlight Africa’s growth potential. As more people want to invest in Africa, it’s important to do your homework. Working with local experts can help make your investment better.

Emerging Sectors for Investment

Africa is quickly becoming a key player in the world of emerging markets. It offers great chances in many areas, like technology, renewable energy, healthcare, and infrastructure. These sectors are growing fast, thanks to new ideas and investments.

Technology is a big area, with lots of startups popping up. Especially in fintech and mobile apps, which have caught the eye of many investors.

Renewable energy is another big deal, thanks to Africa’s natural resources and the push for green living. Countries are investing in solar, wind, and water power. This creates chances for investors.

The healthcare sector is also changing fast. There’s more need for medical services, drugs, and new health tech. This is attracting a lot of interest.

Infrastructure is key too, with governments and partners working together. It’s all about better transport, homes, and utilities. This helps the economy grow. Africa’s move towards new sectors is opening doors for investors looking for growth.

Profitable Business Opportunities in Africa for Foreigners

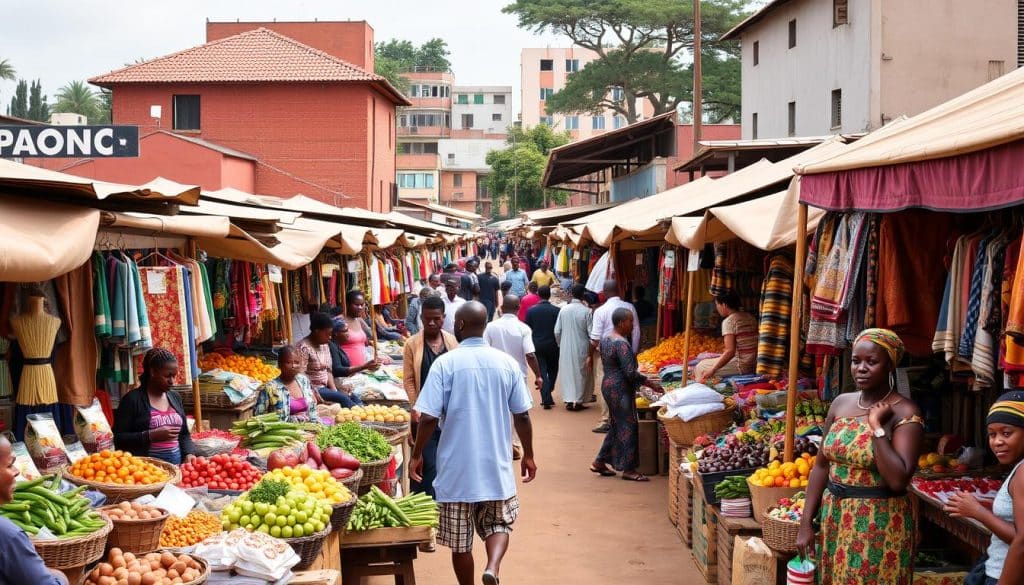

The African continent offers many chances for foreign investors. Sectors like e-commerce, logistics, agribusiness, and tourism are full of potential. With more people online, e-commerce is booming, making it a great place for investment.

Logistics is also key, helping move goods around the continent. Good logistics systems are crucial for Africa’s growing markets. Investors can help improve these systems, boosting the economy.

Agribusiness is another promising area. Africa’s varied climate and land make farming strong. Investing in sustainable farming and new technologies can be very profitable.

Tourism is also big in Africa, thanks to its culture and beauty. It has a lot of room to grow. Foreign investors can bring money and know-how to help it grow.

Success stories show that these ventures can work. Companies that understand local markets and tastes do well. By studying the market, investors can find ways to make their businesses profitable.

Technology Startups and Innovation Hubs

The world of technology startups in Africa is growing fast. This is thanks to a young population and more internet access. Cities like Nairobi, Lagos, and Cape Town are becoming key places for new businesses to start.

These cities are hubs for innovation. They are where young entrepreneurs come to make their mark. Tech incubators and accelerators help them by offering support, advice, and funding.

The Rise of Tech Entrepreneurship

Tech entrepreneurship in Africa is changing the business scene. Young minds are full of ideas and want to solve local problems. This has led to many financial technology startups.

These startups serve local markets but also look to expand across Africa. They focus on solving unique problems. This makes them relevant and sustainable.

Investment Opportunities in Fintech

Fintech investment in Africa is becoming more popular. It’s attracting both local and international investors. The African fintech scene is growing, offering many chances to improve financial access and payment systems.

Successful fintech startups show the potential of this area. Factors like mobile money and good regulations help. The need for easy financial solutions means there are good investment opportunities.

Agribusiness and Sustainable Farming

The agribusiness sector in Africa is changing fast. It’s focusing on sustainable practices and big investment chances. Foreign investors can find great opportunities in agriculture that meet global needs.

Key Agribusiness Trends

Several trends are shaping Africa’s agriculture. These include:

- Organic farming: More people want organic food, opening new markets.

- Agro-processing: Turning raw products into value-added goods boosts profits and attracts investors.

- Smart agriculture: Using technology improves farming, leading to better yields and sustainability.

Export Potential of African Agricultural Products

African agricultural exports are in high demand. Products like cocoa, coffee, and tropical fruits are sought after. This presents a great chance for foreign investors to work with local farmers and businesses. Key things to think about are:

- Favourable trade agreements: Deals like the African Continental Free Trade Area make it easier to enter markets.

- Export policies: Knowing government rules helps navigate the market.

- Logistical frameworks: Good transport and supply chains ensure products reach markets on time.

Real Estate and Infrastructure Development

Africa’s property market is growing fast, thanks to rapid urbanisation and a rising population. Cities are getting bigger, leading to more demand for homes, offices, and infrastructure. This growth offers big chances for real estate investment in Africa, especially in urban planning.

As governments focus on building better infrastructure, foreign investors can get involved in many projects. They can invest in:

- Apartments and homes for the growing city population.

- Commercial spaces like offices and shops.

- Partnerships to improve key infrastructure like roads, schools, and hospitals.

Developing areas in Africa also have great potential. Countries are making policies to help the property market, making it easier for investors. They’re working on simpler rules, financial help, and laws to attract more foreign money.

Real estate and infrastructure development in Africa help investors and boost the economy. It also improves life for local people. The sector is set for more growth and good returns. Investing now could be very rewarding for those interested in Africa’s future.

Tourism and Hospitality Investment Potential

Africa’s tourism sector is booming, thanks to its diverse cultures, stunning wildlife, and landscapes. As more people travel worldwide, investing in Africa’s tourism is becoming more attractive. Visitors are drawn to the continent’s beauty and lively traditions, leading to more tourists.

Investing in the hospitality sector is key to welcoming more visitors. This includes hotels, lodges, and eco-resorts that make travel better. The rise in tourist spending shows the economic benefits of this sector.

However, there are challenges like poor infrastructure and uneven service quality. Improving these will make visits better and attract more investment. Working together, governments and investors can grow the tourism industry sustainably. This will create a strong economy that helps both the industry and local people.

Healthcare Sector Growth in Africa

The healthcare sector in Africa is growing fast. This is due to a higher demand for better healthcare. Investment in new healthcare ideas, like telemedicine, is playing a big role. This growth offers many chances for investors to make money.

Telemedicine and Health Tech Ventures

Telemedicine is changing how we get healthcare in far-off places. It lets patients talk to doctors from anywhere. Health tech investment in Africa is all about using mobiles to reach more people.

This creates a great space for new ideas. It helps startups and big companies find solutions to health problems.

Private Healthcare Alternatives

More people are choosing private healthcare in Africa. They want better and quicker care. This is making private healthcare more popular.

Investors have many chances in this area. They can look into building hospitals, outpatient services, and health insurance. This helps make healthcare better and more lasting.

Green Energy and Renewable Resources

Africa is a big chance for green energy investment, thanks to its rich natural resources. The continent has a huge potential in solar, wind, and hydroelectric power. Countries in Africa are now seeing the importance of sustainable energy solutions.

Solar energy is a top choice for development, thanks to the high sunlight levels in many areas. New projects are starting to use this sunlight, especially in remote communities. Wind energy is also growing, especially near the coast where winds are stronger. Hydroelectric power is a big deal too, with many rivers used for large projects.

Laws in many African countries are changing to support green energy. Governments are offering tax breaks and grants to encourage renewable projects. They see the benefits of sustainable energy, like creating jobs and selling clean tech.

New technologies are helping the sector grow. Improvements in battery storage, smart grids, and energy efficiency are making energy solutions better. As investors look for new chances, focusing on renewable energy in Africa is key to a greener future.

Mining and Natural Resources Exploration

Africa is rich in minerals, offering many mining opportunities for investors. The continent has a wide range of key minerals like gold, diamonds, and rare earth elements. These minerals are vital for global supply chains, affecting many industries and economies.

Key Minerals and Their Market Value

The value of minerals from Africa is high, attracting investors worldwide. Gold is a big player, with South Africa and Ghana leading in production. Diamonds from Botswana and Angola also add to the region’s wealth, providing good returns.

- Gold: Gold is always in demand, with prices changing based on the world’s economic health.

- Diamonds: The diamond mining sector brings in a lot of money, with different qualities affecting prices and demand.

- Rare Earth Elements: These minerals are key for tech and green energy, leading to increased demand.

Knowing the rules is key for mining success in Africa. Many African governments are working to improve their natural resources investment laws. This will help ensure mining is done sustainably and boosts economic growth. The new laws will open up new chances for mining projects.

Education and Skill Development Opportunities

Investment in education in Africa shows big gaps in learning and skills. This opens up chances for EdTech to make learning better and more accessible. Investors can make a real difference and tap into a growing market.

Investing in EdTech Solutions

More investors see the value of EdTech in Africa. New tech helps in traditional and online learning. It makes education available everywhere, preparing people for jobs.

- Mobile learning platforms enhancing remote education.

- Interactive content driving student engagement.

- Data analytics improving personalised learning experiences.

- Partnerships with local institutions to ensure relevance and impact.

Investing wisely in these technologies can change education for the better. It will help improve lives and boost the economy across Africa.

Finance and Investment Trends for Foreigners

The finance scene in Africa is changing fast, offering many chances for foreign investors. It’s important to know about the current financial trends in Africa. This includes things like stable currencies and good returns in different areas.

Foreign investors are keen on tech, farming, and building projects. This shows Africa’s growth story. Market analysis points to high demand for new tech and farming solutions. These areas offer good returns and help the environment.

Investors need to watch out for risks in certain sectors. Knowing about local banks and venture capital helps a lot. This knowledge helps investors do well in Africa’s fast-changing economy.

Risk Management in African Ventures

Entering the African market comes with many business risks. Investors face challenges like political instability, economic ups and downs, and cultural differences. It’s key to understand these risks to craft effective investment strategies for success.

Political risks can greatly affect investments. It’s important to study the political scene in target countries. Knowing local governance and political subtleties helps avoid disruptions. Also, economic instability from currency changes and inflation needs careful financial planning.

Cultural risks can also be a hurdle for foreign investors. Misunderstandings can lead to conflicts or business failures. Working with local experts and building strong partnerships can help. Also, a broad risk management Africa approach is essential.

- Regular risk assessments to spot potential threats.

- Diversifying investments to spread risk across sectors.

- Creating backup plans for unexpected events.

- Working with local stakeholders for advice.

- Keeping up with regulatory changes and market trends.

By tackling these risks, foreign investors can do well in African markets. This also helps the region’s economy grow. A proactive risk management Africa strategy boosts returns and supports lasting business growth.

Cultural Considerations for Successful Business Practices

Understanding cultural differences in Africa is key for foreign investors. It opens doors to building strong business relationships. Each region has its own culture, so a customised approach is needed.

Building trust is crucial in many African cultures. Making personal connections helps in negotiations and builds respect. Starting with informal chats before business talks shows you care about local customs.

- Respect local traditions and practices, as these can impact business interactions.

- Be aware of hierarchical structures within companies and formal greetings.

- Understand the importance of face-to-face meetings, which are often preferred over emails or phone calls.

Adapting to these cultural differences can boost business success in Africa. Showing respect for local customs and using effective communication strategies is vital. This way, foreign investors can create lasting professional connections.

Legal Framework and Regulatory Environment for Foreign Investors

Foreign investors looking at Africa face a complex legal landscape. Laws on investment vary greatly across the continent. Each country has its own rules to help or hinder foreign investment.

It’s key to know these laws well to follow them and get the best returns. Many African countries have made laws to attract foreign money. These laws offer things like tax breaks and easier ways to start businesses.

Protecting foreign investors is very important. There are many ways to make sure their rights are respected. For example, there are special treaties and ways to solve disputes through arbitration.

- Knowing the local laws is essential for success.

- Bilateral investment treaties can offer more protection.

- Understanding the laws of the country you’re investing in helps a lot.

Investors should really research the legal situation in the countries they’re interested in. Knowing the rules and protections can help them make better choices. This can increase their chances of doing well in Africa.

Successful Case Studies of Foreign Investments in Africa

Looking into successful foreign investments in Africa shows the continent’s economic strength. These stories are great for investors, showing what works and how to succeed.

Some top foreign investment success stories are:

- Kenya’s Safaricom: Started with outside help, Safaricom is now a top name in mobile tech and payments. Its M-Pesa service changed how people manage money in Kenya.

- Heineken in Nigeria: Heineken’s move into Nigeria’s beer market shows the power of fitting in with local tastes. This approach helped the company grow its share in the area.

- Chinese Investments in Zambia: Chinese companies have put a lot into Zambia’s mining. Their efforts have not only increased mining but also improved roads and created jobs.

These examples point out important things for successful investments in Africa:

- Knowing the local culture and what people want.

- Working with local businesses in smart ways.

- Matching investment plans with the country’s goals.

As more foreign money comes into Africa, these success stories will guide new projects. They will help the continent grow economically in a lasting way.

Networking and Building Local Partnerships

For foreign investors in Africa, networking is key. Building strong local partnerships boosts credibility and offers deep insights into the market. Working with local people helps investors understand cultural differences, leading to better business collaborations.

Local partners can greatly improve decision-making in foreign ventures. They know the local business scene and what customers want. This knowledge helps reduce risks and speed up market entry.

Creating a network of local contacts can lead to new chances and resources. Events, trade shows, and community activities are great for networking in Africa. Investing in these connections can create a vital support system for navigating the African market.